Savings

The society shall accept regular savings and special deposits from a member at a reasonable rate of return.

Save for rainy days.

Our Savings Products

Reasonable savings return for your investments.

Member Savings Account

The society accepts and encourages regular savings and special deposits from a member at a reasonable rate of return . Members Savings Account requires a minimum of P200.00 per month which accumulates interest per annum. These savings are used as collateral for loans.

Fixed Deposit

With this account, a member gets to save a lumpsum for a fixed period of time. This lumpsum amount earns a competitive interest after the period elapses. A member can choose to re-invest the lumpsum after the period elapses. Withdrawals can only be made twice a year, thus encouraging saving.

Nkgodisa Savings Plan

Nkgodisa is a savings plan for children of Orapa SACCOS members, with this plan one gets to save for their children’s future at competitive interest rates. Qualifying ages range up to 18 years.

Products of the Moment

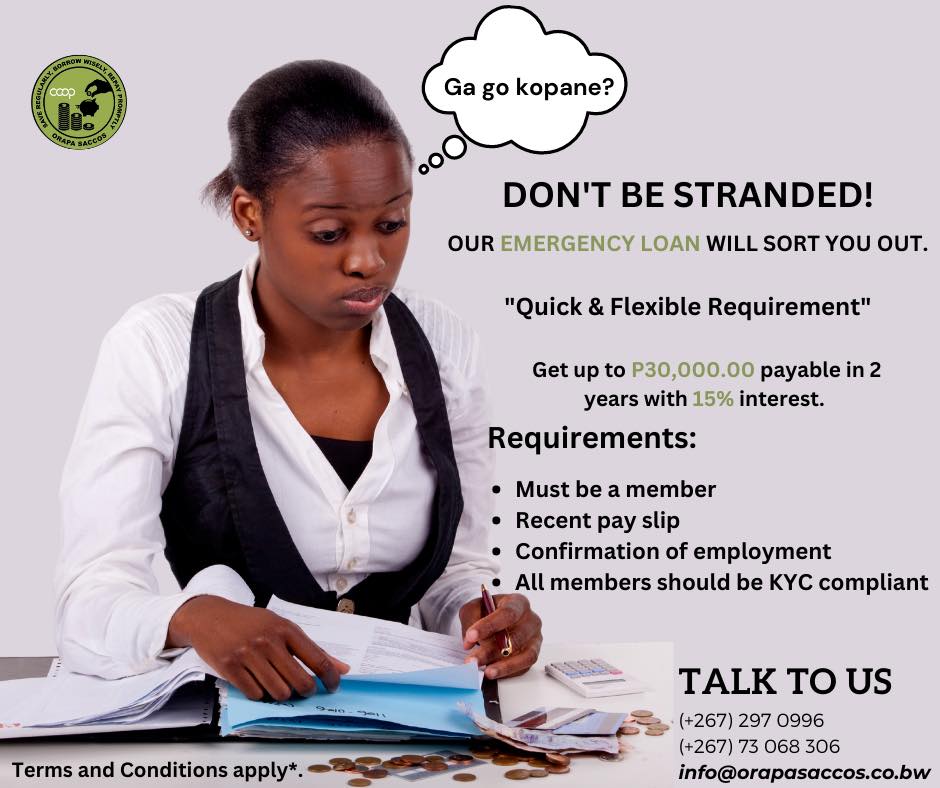

Short Term Loan

Need to cover unexpected expenses, but short of cash? “Ga go kopane?”. Get a short term loan also known as an Emergency loan with us “O thibe ha go thibegang teng”.

Let us help you

Say Hello!

Fill the contact form below and we will get back to you as soon as we see the message.